30+ Low credit score loan approval

Lower interest rates on any kind of loan including credit cards. Experians Credit Score free subscription to your score.

What Is The Average Credit Score In America Credit Com

11 Ways to Improve Your Credit on a Low Income You can build credit on a low income by paying bills on time opening a secured card and more.

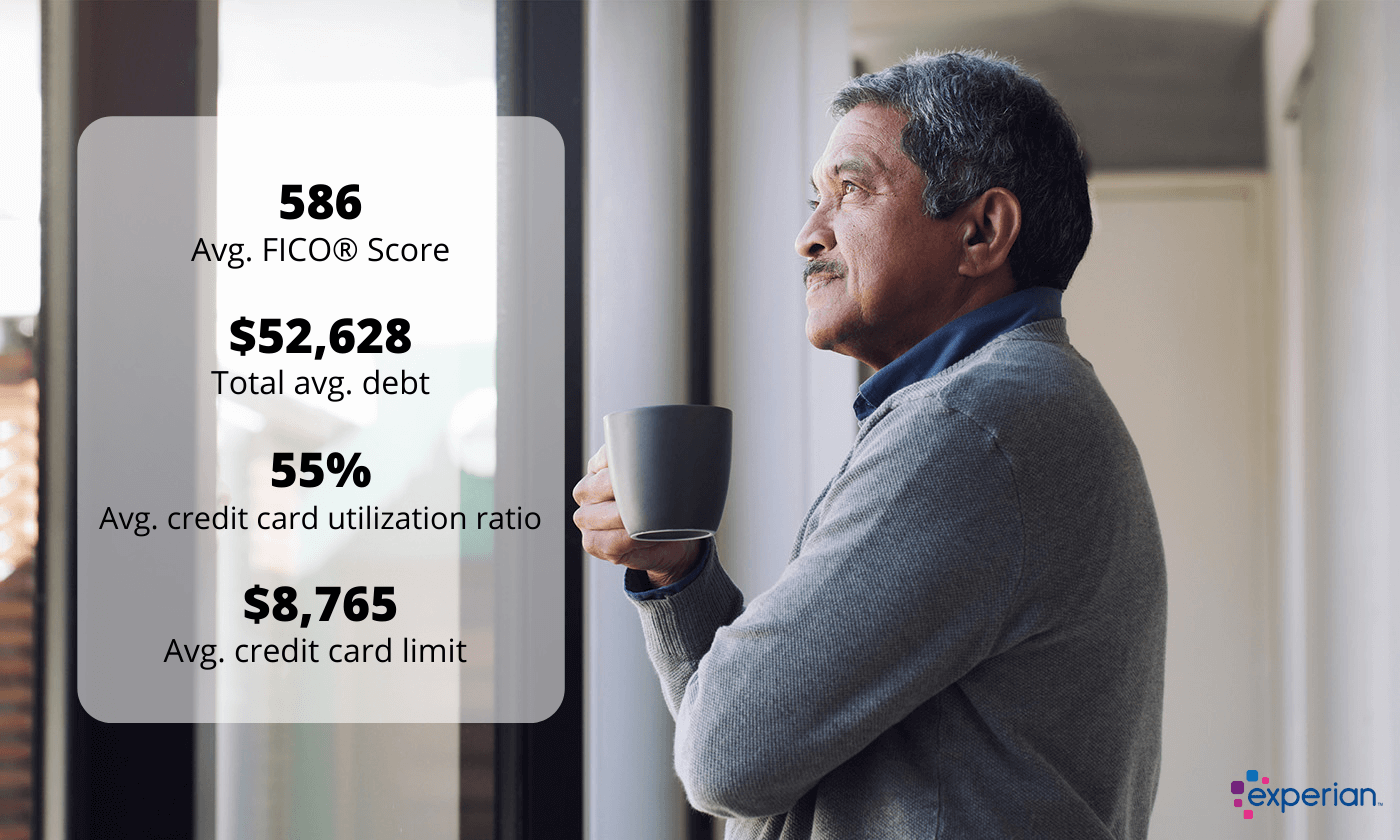

. Getting pre-approved for an SCCU auto loan does affect your credit score. 300 to low-600s Having poor credit scores can make it difficult to get approved for a loan or unsecured credit card. Your 650 FICO Score is lower than the average US.

They look specifically at a loan applicants credit score. But a poor credit score isnt a financial dead end. Pay off your credit card balances with a personal loan.

Credit Score Requirements. USDA loans for low-income buyers in rural and suburban areas. Every credit report is different and there are many credit scoring models available.

Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score. A FICO Score of 650 places you within a population of consumers whose credit may be seen as Fair. Minimum credit score 620 3 down HomeReady loan.

Get legit personal loan evan if with very bad credit. Similarly the loan amount required and the amortization period requested will also play a role in the credit score required for mortgage approval. We help you avoid predatorly lenders.

While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to get approved for a loan and the loan terms. If youre a veteran or active-duty service member you could get a Department of Veterans Affairs VA loan. Credit score calculated based on FICO Score 8 model.

Results may vary. No Payments for up to 120 Days 11. Minimum credit score 620 3 down Home Possible loan.

However getting a loan with bad. Entrepreneurs likely need a credit score in the mid to high 600s to meet SBA loan credit score requirements though the SBA does not have a specific minimum. If you dont know your credit score use our free credit score estimator tool to get a better idea of which cards youll qualify for.

Some may not see improved scores or approval odds. FHA loans allow low income and as little as 35 percent down with a 580 credit score. Credit Score requirements are based on Money Under 30s own research of approval rates.

12 to 60 months. A credit score is a numerical expression based on a level analysis of a persons credit files to represent the creditworthiness of an individual. Not all lenders use Experian credit files and not all lenders use scores impacted by Experian Boost.

One of the balance transfer credit card offers available on Bankrate could help you pay down balances improve your credit score and save on interest charges plus some earn great rewards. Score for SBA loan programs. You wont have to pay anything but the information is limited to seeing your credit score as opposed to credit report.

There is no universal solution to improving your credit score. A credit score is primarily based on a credit report information typically sourced from credit bureaus. A poor credit score is one of the most common problems in todays economy and can severely impact your ability to qualify for an unsecured loan from banks.

24 30 or 36. Here are 9 ways to improve your credit score before you apply. Minimum credit score 660 3 down Non-QM loan.

Meeting the minimum score will give you the best chance to be approved for the credit card of your choice. For example a borrower with a high income and low debt amount might be able to get away with a slightly lower credit score than a borrower with a lower income and lots of debt. Poor credit scores.

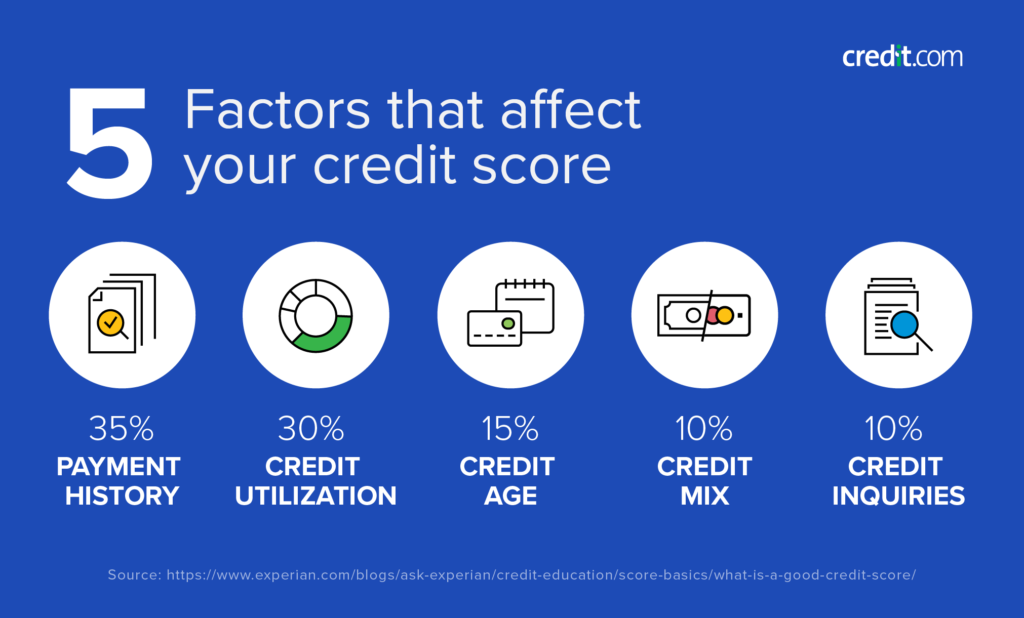

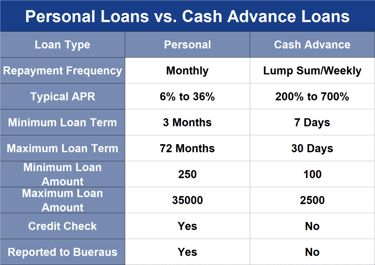

Because credit utilization rates are a reflection of how you use revolving credit you could take out a personal loan pay off your credit cards and effectively move the debt to an installment loan potentially with a lower interest rate than your credit cards. Your outstanding debt accounts for 30 of your. Annual contractual rate.

Low minimum credit score requirement. The minimum credit score for SBA disaster loan programs is in the high 500s. 17 of all consumers have FICO Scores in the Fair range 580-669.

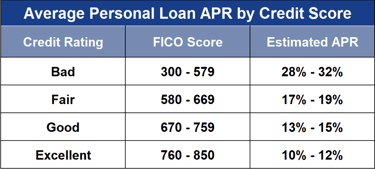

Avants minimum FICO credit score is 580 the lowest among the four lenders on this page that disclose their credit score requirements. Youll likely need a good credit score to qualify for low personal loan rates. The score updates every 30 days.

Impact on bad credit borrowers. Statistically speaking 28 of consumers with credit scores in the Fair range are likely to become seriously delinquent in the. Shoot for a credit score of 620 or above if youre looking for a conventional loan.

Low Auto Loan Rates 8 for New and Used Vehicles Flexible Terms 9. 30000 to 1 million. FHA loans backed by the Federal Housing Administration FHA require a credit score of at least 500.

A few popular options include. Contact SCCU for car loan pre-approval before you start car shopping. Interest rates cap at 8 and can have repayment terms up to 30 years.

Your credit score can help you get approved for attractive borrowing rates and repayment terms when you apply for most loans including mortgages auto loans personal loans and credit cards. Legit personal loans offer up to 35000 APR 599 to 3599 and approve in less than a day. Certain financial products like secured credit cards can help people who are working on building their credit.

Lenders can make whats. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the Q2. But if its low you might be approved with a high-interest rate or worse.

15-Year Vs 30-Year Mortgage Calculator. Auto loan pre-approval can save you time and even money. But finding a co-signer with a high credit score can improve your chances of approval or available loan terms.

You have a great chance of getting a low-interest personal loan if your credit score is high. These products can be a helpful stepping. Lenders such as banks and credit card companies use credit scores to evaluate the potential risk posed by lending money to.

The as low as 670 credit score requirement makes the card more accessible. If you dont want to pay a subscription to see your credit report you can sign up for free to see your Experian Credit Score. Minimum credit score 500.

VA loans a. Try these 11 tips to boost your credit score on. The likelihood of applicants credit approval.

21 Best Credit Cards For Low Credit Scores 2022 Badcredit Org

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Best Credit Cards For Bad Credit Of September 2022 Creditcards Com

What Makes Your Credit Score Go Up And Down

7 Small Loans For Bad Credit Online 2022

Fewer Subprime Consumers Across U S In 2021 Experian

How To Quickly Remove Mortgage Lates From Your Credit Report

11 Low Credit Score Credit Cards 2022 Badcredit Org

8 Credit Cards For A 500 Credit Score 2022 Badcredit Org

Buying A Home With Bad Credit In Grand Rapids Mi Michigan Bad Credit Mortgage Loans

Best No Credit Check Loans Guaranteed Approval Top 5 Mortgage Lenders Providing Personal Loans For Bad Credit In 2022 Paid Content Cleveland Cleveland Scene

What Is The Average Credit Score In America Credit Com

9 Guaranteed Approval Credit Cards For Bad Credit 2022

6 Best Credit Cards For Poor Credit 2022 S Top Bad Credit Offers Badcredit Org Badcredit Org

Best Credit Cards For Bad Credit Of September 2022 Creditcards Com

13 Easy Credit Cards To Get With Bad Credit Badcredit Org

7 Small Loans For Bad Credit Online 2022